north dakota sales tax exemption

In North Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. North Dakota Form.

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

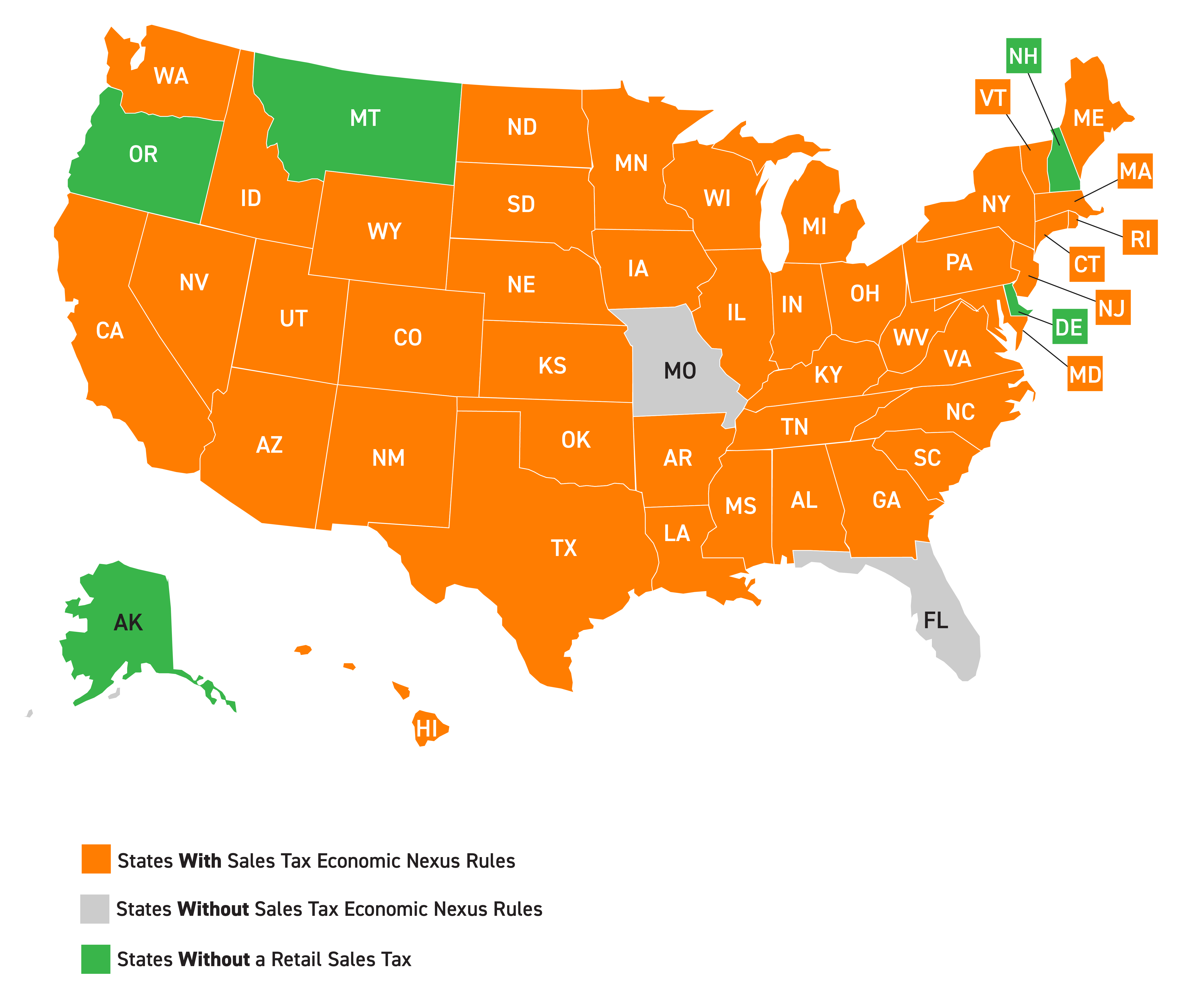

States With Minimal Or No Sales Taxes

This page describes the taxability of.

. Oil refineries may be granted a sales and use tax exemption for purchasing building materials equipment and other tangible personal property used in the expansion or construction of an oil. Fill out the North Dakota. No Sales Tax Exemption Available.

Remote sellers with no physical presence in North Dakota are required to collect state and local sales tax on taxable sales made into North Dakota unless they qualify for the small seller. No Sales Tax Exemption Available. This can be regularly attained simply by making marketing.

North Dakota Office of State Tax. North Dakota Office of State Tax Commissioner. You can download a.

Several examples of exemptions to the state sales tax are prescription. North Dakota Sales Tax Exempt Form An employee must be able to make sales in order to be exempt from sales tax. 127 Bismarck ND 58505-0599 Main Number.

North Dakota tax exemption info. Ohio Form Example. Some examples of items that exempt from North Dakota sales tax are prescription medications some types of groceries some medical devices and machinery and chemicals.

Groceries are exempt from the North Dakota sales tax. This does not include. Durable Medical Equipment means equipment for home use including repair and replacement parts.

To apply for a sales tax exemption the taxpayer must submit a letter of application to the Office of State Tax Commissioner by email or mail. While North Dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Counties and cities can charge an additional local sales tax of up to 3 for a maximum possible combined sales tax of 8.

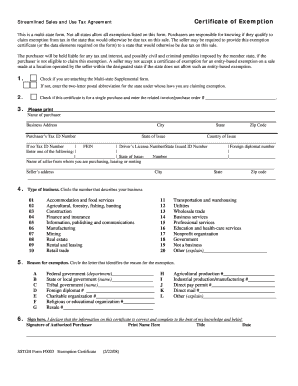

Therefore you can complete the ND resale certificate form by providing your ND Sales Tax Number. If you are a retailer making purchases for resale or need to make a purchase that is exempt from the North Dakota sales tax you. North Dakota Sales Tax Exemption Resale Forms 2 PDFs.

Form RW-EXM - Exemption Status for Royalty Withholding for Publicly Traded Partnership and Tax Exempt Organization 2022 Form RWT-1096 - Royalty Withholding Annual Return and. Through this program certain industries in North Dakota may qualify for a sales tax exemption. You can download a.

Obtain a North Dakota Sales Tax Permit. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the North Dakota sales tax. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the North Dakota sales tax.

Devices equipment and supplies are exempt from sales tax. Copyright 2022 North Dakota Office of State Tax Commissioner 600 E. To obtain the sales tax exemption certificate eligible organizations must contact the Office of State Tax Commissioner.

North Dakota Nonprofit Annual Filing Requirements Nd Nonprofits Registration Reinstatement

Form 21999 Fillable Streamlined Sales And Use Tax Agreement Certificate Of Exemption

4 Reasons A Transaction May Be Exempt From South Dakota Sales Tax South Dakota Department Of Revenue

Bill Of Sale Form North Dakota Tax Power Of Attorney Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Bill Of Sale Form North Dakota Tax Power Of Attorney Form Templates Fillable Printable Samples For Pdf Word Pdffiller

North Dakota Sales Tax Exemptions Agile Consulting Group

Start A Nonprofit In North Dakota Fast Online Filings

Burgum Signs Bill Providing State Income Tax Exemption For Military Retirement Benefits

North Dakota Rejects Tampon Tax Exemption Avalara

North Dakota New Sales Tax Exemption For Data Centers Avalara

North Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

North Dakota Sales Tax Exemptions Facilitate Disaster Relief Avalara

Form Sfn 21854 Certificate Of Purchase Exempt Sales To A Person From Montana

Form 21999 Fillable Streamlined Sales And Use Tax Agreement Certificate Of Exemption

North Dakota Charitable Registration Harbor Compliance

Exemptions From The North Dakota Sales Tax

Out Of State Sales Tax Compliance Is A New Fact Of Life For Small Businesses

How To Get A Wisconsin Sales Tax Exemption Certificate Startingyourbusiness Com